INTRODUCTION

In today’s unpredictable world, managing risks is crucial for businesses to survive and thrive. For companies in Nigeria, navigating these risks requires a solid understanding of insurance laws and effective risk management strategies. Insurance plays a vital role in safeguarding businesses from unforeseen events like property damage, legal liabilities, or other losses that could disrupt operations. This article aims to simplify how insurance law works in Nigeria and how businesses can use it to manage risks effectively.

Understanding Insurance Law in Nigeria

Insurance law in Nigeria is a framework that regulates how insurance policies are created, sold, and enforced. It ensures that both the insurer (the company offering insurance) and the insured (the individual or business purchasing insurance) follow set rules. The key agency responsible for regulating insurance in Nigeria is the National Insurance Commission (NAICOM), which ensures that insurers remain financially stable and treat customers fairly.

There are different types of insurance policies available for businesses in Nigeria. These include:

- Property Insurance – This covers damage or loss of business assets, such as buildings, equipment, and inventory.

- Liability Insurance – This protects businesses from legal claims that may arise from accidents, injuries, or negligence.

- Life and Health Insurance – This provides financial protection for employees, ensuring they receive medical care and their families are supported in case of death.

For businesses, having the right insurance coverage is not just about following the law; it’s about protecting the company’s future.

Business Risk Management: A Necessity

Risk management is the process of identifying, assessing, and taking steps to minimize or prevent risks that could harm a business. In Nigeria, businesses face several risks, such as economic instability, theft, fire outbreaks, and even cyber threats. By integrating insurance into their risk management plan, companies can mitigate the impact of these risks.

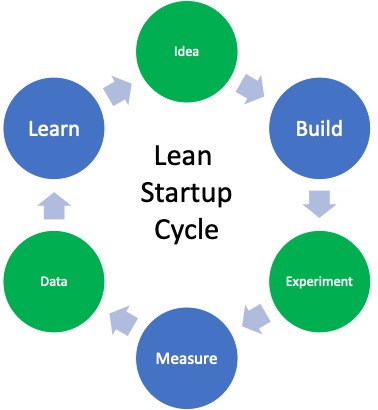

Here are some steps businesses can take to manage risks effectively:

- Risk Identification – The first step is to identify potential risks that could affect your business. This includes both internal risks (like employee-related issues) and external risks (like changes in government policies or natural disasters).

- Risk Assessment – Once identified, businesses need to assess how likely these risks are to occur and what impact they might have on operations.

- Risk Mitigation – This is where insurance comes in. Businesses can transfer risks to insurers by purchasing appropriate policies. For example, a company operating in a high-crime area might get theft insurance to cover potential losses from burglary.

- Monitoring and Reviewing – Risks can change over time, so it’s important for businesses to regularly review their risk management strategies and adjust their insurance coverage accordingly.

How Insurance Supports Business Growth

A well-managed business is one that is prepared for the unexpected. Insurance provides a safety net, giving business owners peace of mind knowing that, in the event of a disaster, their business can recover without suffering huge financial losses. This allows businesses to focus on growth and expansion rather than constantly worrying about potential threats.

For example, a manufacturing company that insures its machinery against damage can resume production quickly after an accident, minimizing downtime and loss of revenue. Similarly, a tech company that takes out cyber insurance can be confident that in case of a data breach, the financial cost of dealing with the breach will be covered.

Conclusion

In Nigeria’s dynamic business environment, understanding insurance law and adopting a strong risk management strategy is key to long-term success. By having the right insurance policies in place, businesses can protect themselves from unforeseen events, manage risks effectively, and focus on growing their operations with confidence. Whether you run a small business or a large corporation, insurance should be an essential part of your risk management plan.